In addition to keeping track of price fluctuations as costs change on open book projects, CoConstruct lets you automatically make adjustments to projected profit and tax according to the rates you've set for the project.

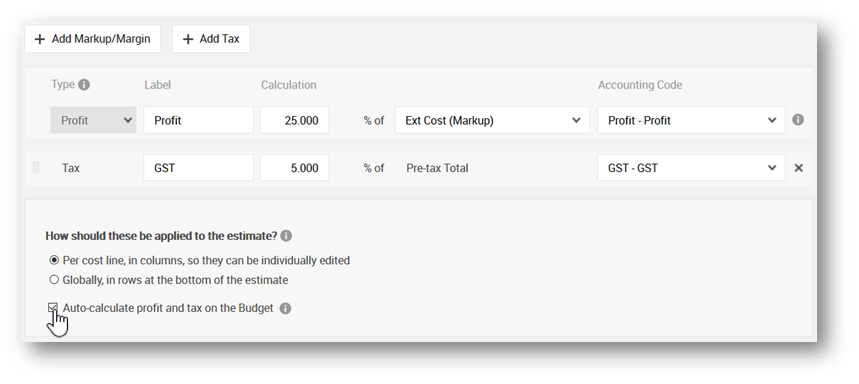

In your open book projects, your Markup, Margin & Tax configuration will give you the option to auto-calculate your projected profit and tax.

To do this, head to the Estimate then select "% Markup, Margin & Tax" to open the project's configuration settings. Check the option for "Auto-calculate profit and tax on the Budget" to leverage this functionality.

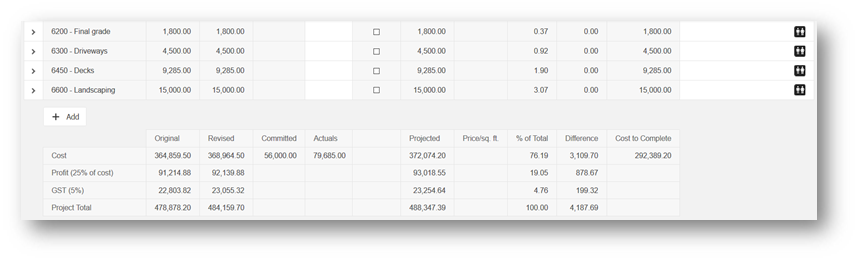

These profit and tax projected totals will be recalculated whenever budget actuals are updated manually or synced from QuickBooks, ensuring that your overall projected total price is as accurate and up-to-date as possible for your team and clients.

With that option enabled, the Budget page of your project will provide greater clarity into how your costs, profit, and tax relate to one another. For your open book projects, rather than a single "Project Total" row at the bottom of your Budget page, you will additionally see totals for cost, profit, and tax, with projections calculated for each.

On open book projects that have client login access and share the budget, clients will also see this breakdown of markup and tax totals and projections.