Overview

If you're running an open book project, many of your project actuals will be determined from your bills and payments or expenses from your vendors. But, what about the revenue items that you pass on to your clients on invoices, for which no bills, payments, or expenses exist? Examples include your profit and overhead items like insurance.

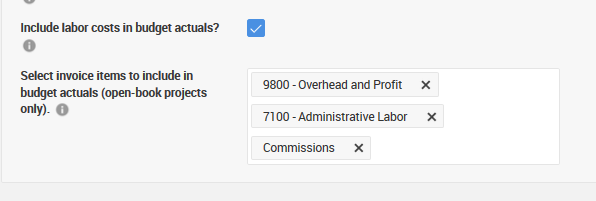

No vendor expenses exist for those items, but they still need to be factored in and shown on the budget for open book projects -- and that's where the "Invoice items to include in budget actuals" option can help you handle these invoice-only items.

What should I select?

For this option, go to your Settings > Accounting if you are an Admin user on your account, and select all of the accounting codes that will not be included in bills or payments that you are entering in your QuickBooks account. You can add or remove as many accounting codes as you want from this list. Typically you will have set up these items as revenue items (rather than expense items) in QuickBooks.

Accounting codes that you have set up for your administrative fees, supervision charges, overhead expenses, or other profit items are suggestions of codes that should be included here.

Be careful not to double count

As you set up your invoice items to include on the budget, remember that the items on your vendor bills and expenses are already being pulled into CoConstruct as budget actuals.

On open book projects, you will likely invoice your clients for those billable items as well. But, since we already pull in your bills, you don't need to tell CoConstruct to also include those items when you then invoice your clients. That would cause us to double-count them. You should only include items on an invoice that ONLY appear on the invoice, but that should be included in your budget.

As an example:

- If you have entered a $10,000 bill from Ivy Excavating for your "2000 - Excavation and backfill" item in QuickBooks, then this is retrieved into CoConstruct as an actual tied to that accounting code.

- On an open book project, you would also be invoicing this cost to your client.

- If you have selected the "2000 - Excavation and backfill" accounting code as an "Invoice item to include on the budget", CoConstruct will treat that $10,000 amount on your invoice as a new actual, separate from the original bill, and you will wind up with a total actual of $10,000 (from the bill) + $10,000 (from the invoice) = $20,000.

To avoid the potential for double counting, you should only select accounting codes for which you will not be entering bills or payments in QuickBooks.

Here's an example of a proper way to set this up:

- If you have entered a $10,000 bill from Ivy Excavating for your "2000 - Excavation and backfill" item in QuickBooks, then this is retrieved into CoConstruct as an actual tied to that accounting code.

- On an open book project, you would also be invoicing this cost to your client.

- On that invoice, you added a line item for "9000 - Profit and Overhead" of $2,000.

- You have selected the "9000 - Profit and Overhead," but NOT the "2000 - Excavation and backfill" accounting code, as an "Invoice item to include on the budget." CoConstruct will then pull in the $10,000 amount from the bill and the $2,000 profit from the invoice, which is exactly what you want. Therefore, your overall budget on CoConstruct will properly reflect a change of $12,000.