In order to start pulling labor actuals from QuickBooks Desktop, you will first need to make sure you have set up the QuickBooks integration. If you haven’t set up your integration yet, you can find more information on that process here.

CoConstruct will pull the hours, customer, service item and payroll item details from your QuickBooks timesheets to determine what should be entered into the budget of a particular job. You can push this data from your CoConstruct Time Clock or manually enter the data into QuickBooks timesheets.

In this article, we’ll walk through:

Setting up your Labor Rates

In CoConstruct, you will enter a rate for each employee and payroll item (if applicable) for these timesheet hours to calculate against to determine the dollar amount of your labor actuals.

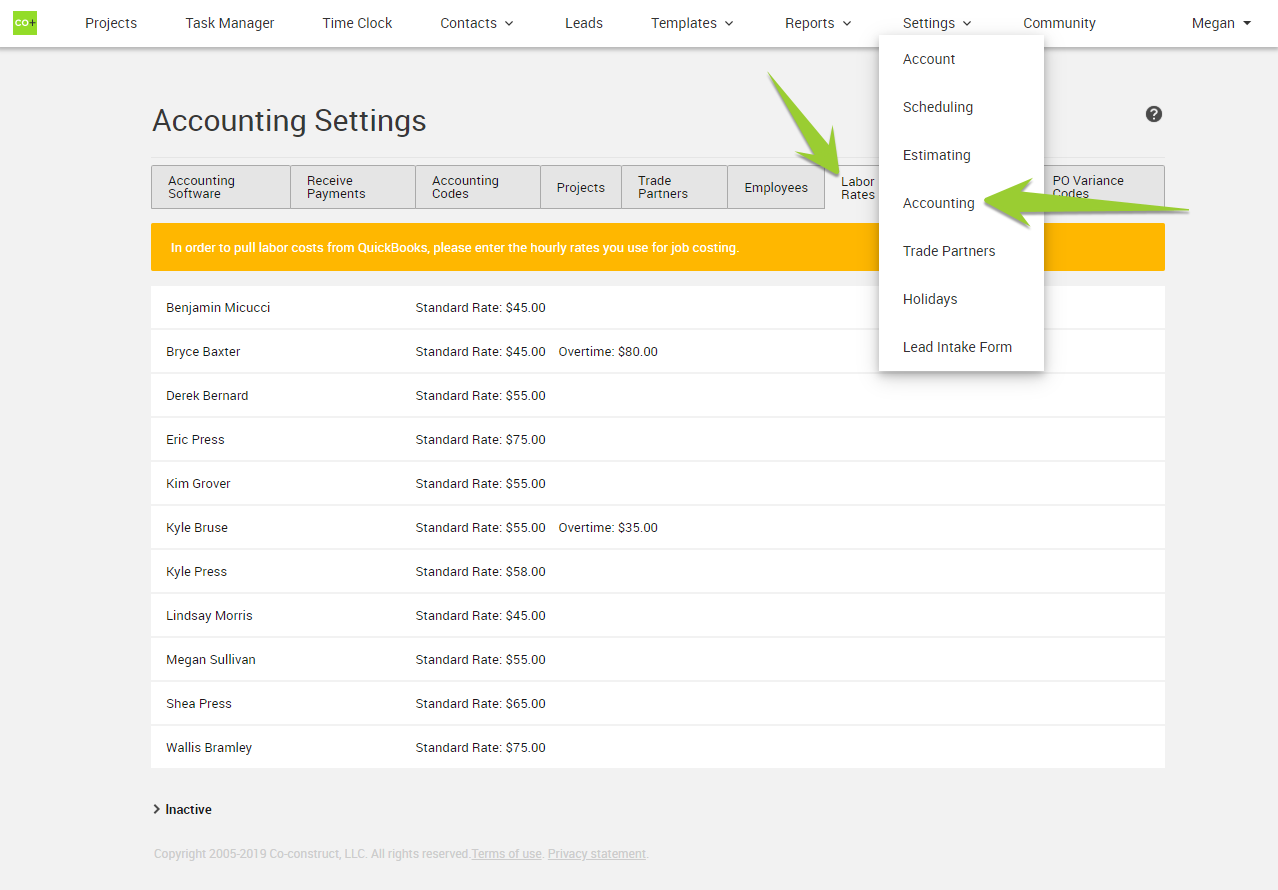

To set this up in CoConstruct, go to your Settings > Accounting > Labor Rates:

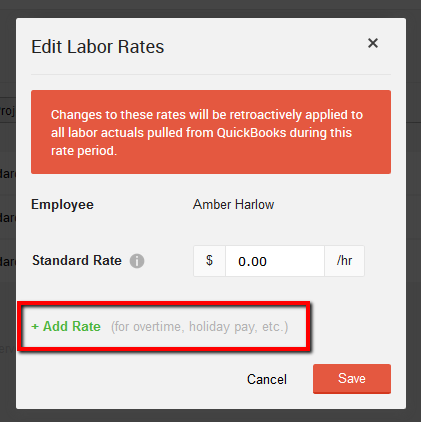

On this tab, you will see a list of all of your active employees in QuickBooks. To set their standard rate, you will click on the employee name > Edit > Enter the rate you wish to use:

These rate values do not carry over to QuickBooks in any way – they are exclusive to CoConstruct’s calculation of your labor costs.

How to Determine your Labor Rates

The value you enter here as the Labor Rate will be used to calculate the labor portion of your budget actuals when you sync with QuickBooks. This will typically be your burden rate for the employee including their pay, payroll taxes, workers comp, etc. in order to accurately calculate your cost for the labor. You may want to consult with your bookkeeper or accountant to establish what these values should be for each of your employees.

Setting up Additional Rates for an Employee

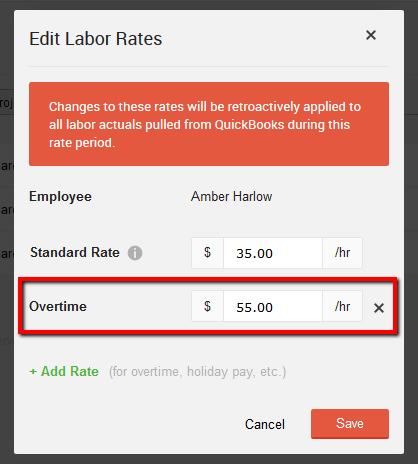

If only the Standard Rate is set up in CoConstruct, all time entries pulled from QuickBooks for that employee will be calculated by that rate. If you need to set up varying rates for an employee, CoConstruct allows you to set up a different rate for each QuickBooks Payroll Item for each individual employee. To set up these varying rates, you will use the “Add Rates” option in the Edit Labor Rates window:

Here you will select the appropriate Payroll Item from the drop down and enter the new rate:

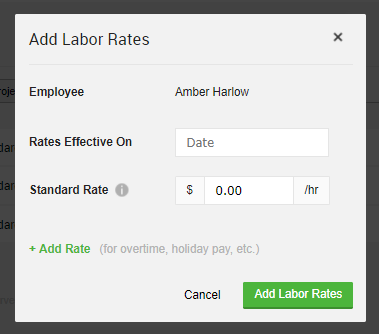

Setting up a New Rate Period

Many times, you may face an instance where an employee is given a promotion or raise where their burden rate changes. To account for this, CoConstruct has allowed you to set up a “New Rate Period” in the same window you set up your standard rate above.

In the New Rate Period, you’ll enter a date to start that new rate for the employee and their new burden rate:

You’ll be able to enter a new rate for each Payroll Item within this updated period. Any hours pulled in from prior to the effective date you enter will remain at the initial standard rate.

Setting up a Project to Import Labor Actuals

Before you can start pulling labor actuals for a project from QuickBooks, you’ll first want to make sure that the project is linked to the appropriate QuickBooks customer.

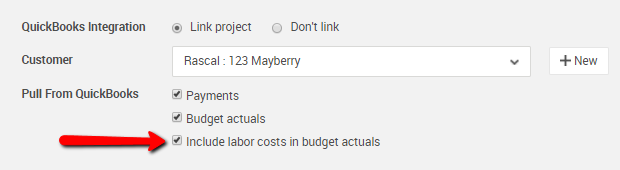

From the project’s setup page: Go into the setup page of the project you wish to pull labor actuals on. In the “QuickBooks Integration” section, choose Link Project > Select the Customer and Job (if applicable) from QuickBooks > check to pull Budget Actuals from QuickBooks > check to Include labor costs in budget actuals.

You can also set the defaults on your main Accounting Settings page to automatically set the labor actuals to pull when linking the project to QuickBooks.

**Please note that if you have manually entered actuals on the project’s budget page prior to linking the project to QuickBooks, these will be erased from the project to allow the data to be pulled in from your QuickBooks file.

How Labor Actuals Appear in the Budget

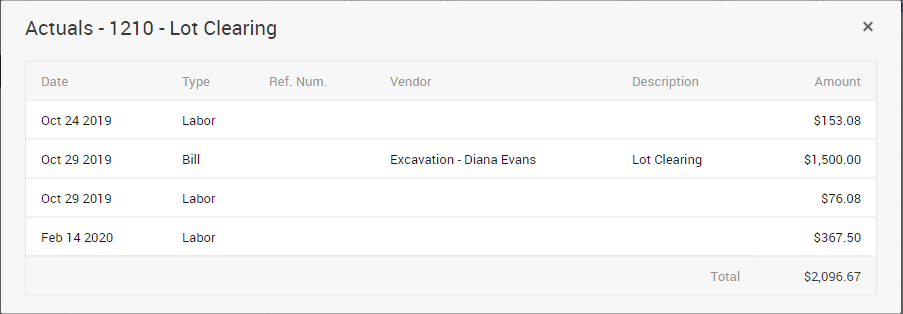

Once you’ve followed the steps above, CoConstruct will be able to pull your labor actuals information into the Budget page. CoConstruct pulls the hours, project, service item and payroll item information in from the employee’s Timesheet in QuickBooks and calculates that by the corresponding Labor Rate you’ve established in your set up.

Within the budget page, the total dollar amount of your labor actuals for all employees on a certain date and project will appear under the appropriate accounting code.

Now, with your labor costs included in the budget actuals totals, you’re able to get a more complete cost report for your project!