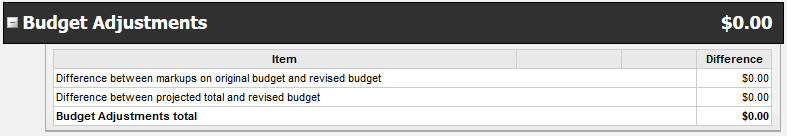

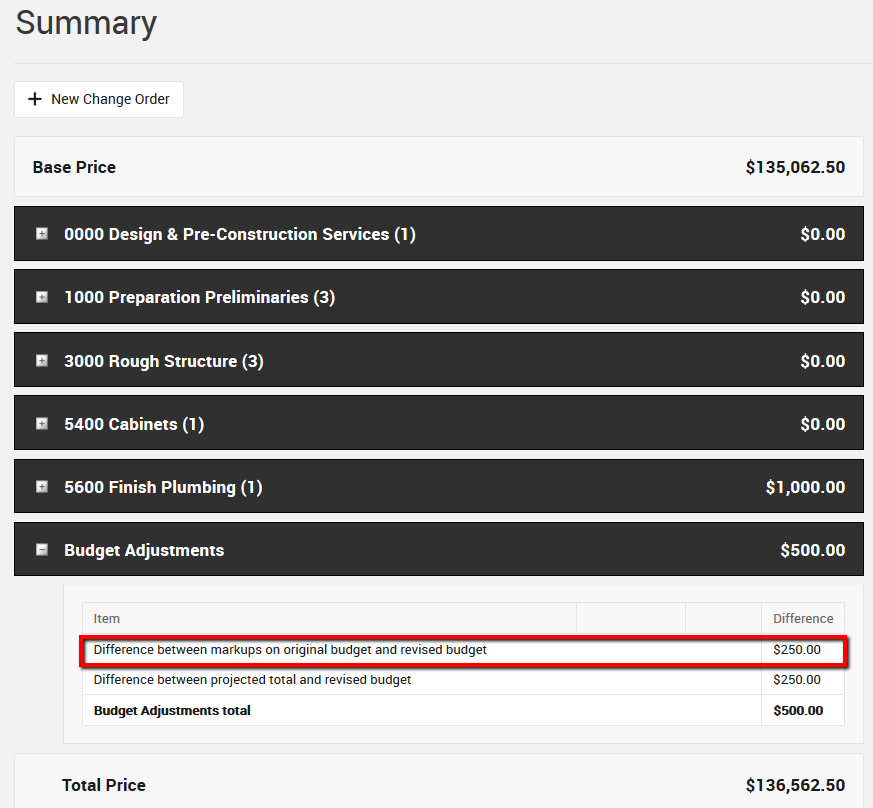

If you’re running an open book project, you will find a category on your Financial Summary page titled Budget Adjustments that lives near the bottom of the page. You may see a single line or two under this section that will affect your client’s price depending on what you as the builder spend on the constructions -- differences with markups on original and revised budget VS differences between projected total and revised budget.

In an open book project, your client is responsible for your cost, plus your markups. So, any cost over what you expect to pay is automatically charged to the client and any cost under what you expected to pay is credited back to your client. Those changes are captured in the Budget Adjustments section.

Markups on Original Budget & Revised Budget

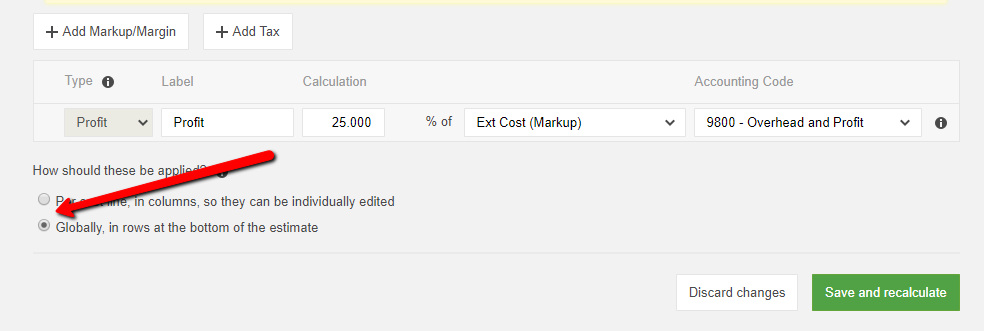

This line will be present under the budget adjustments ONLY on open book projects where you have set your markup to Globally, in rows at the bottom of the estimate. The purpose of this section is to account for your bottom line percentage profit to any additional costs that come up during the course of your build, such as through change orders, upgrades, or downgrades.

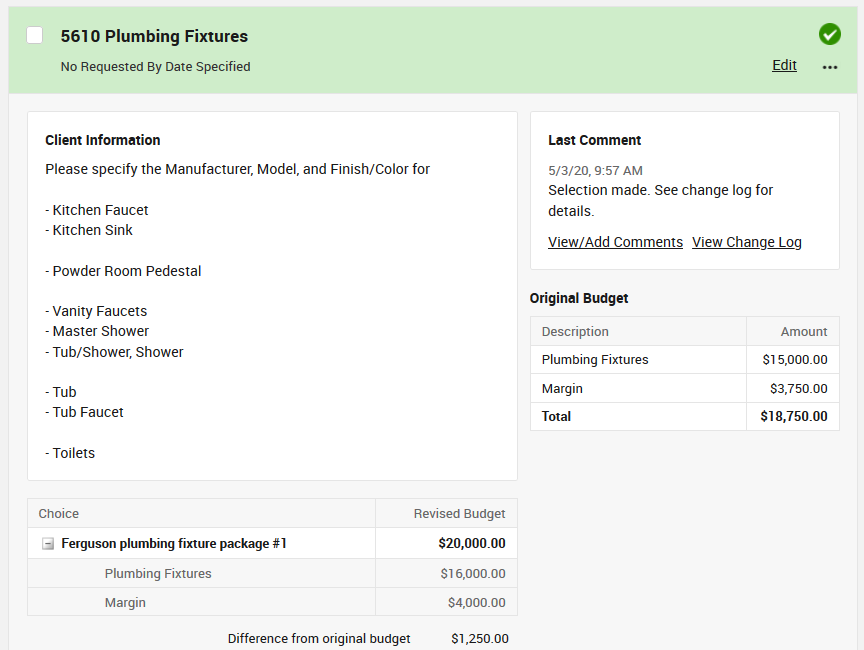

Using the same example above where we budgeted $15,000 for plumbing fixtures, let’s say we had a 25% markup calculating our profit. This would mean that we built in $3,750 of profit into our contract price for this cost.

When the client makes the decision that increased the cost to $16,000 the system will automatically calculate the additional $250 in profit under the budget adjustments for you.

Projected Total & Revised Budget

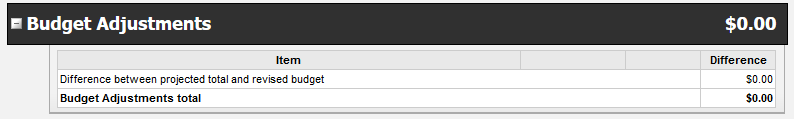

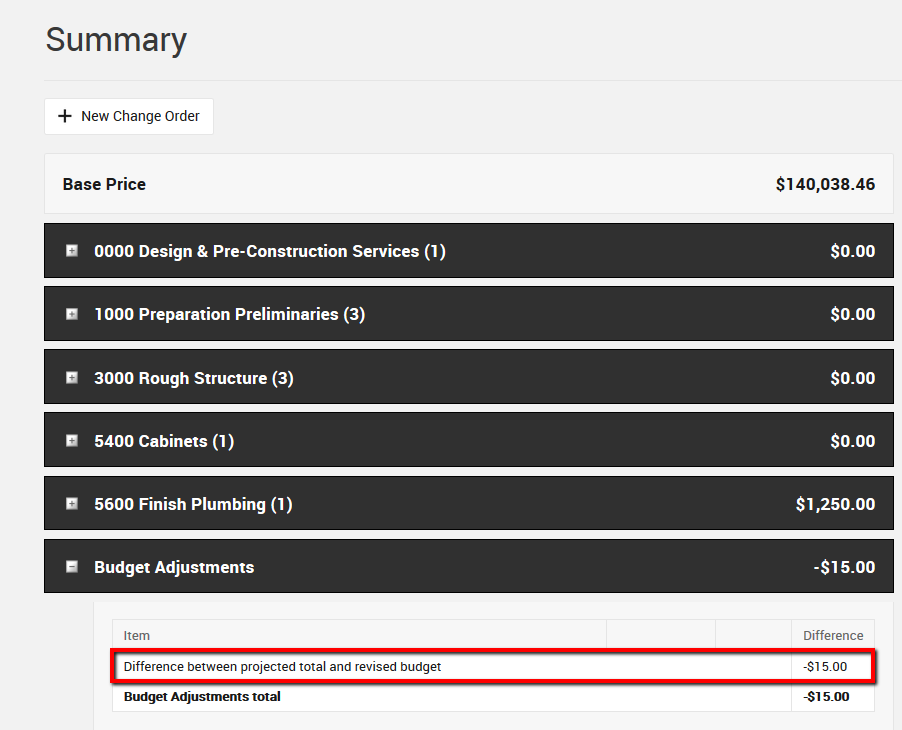

This will be present on ALL open book projects under the Budget Adjustment category on the Financial Summary page. The purpose of this section is to account for any overages or credits to the client based upon the actuals that you as the builder are adding to your Budget page.

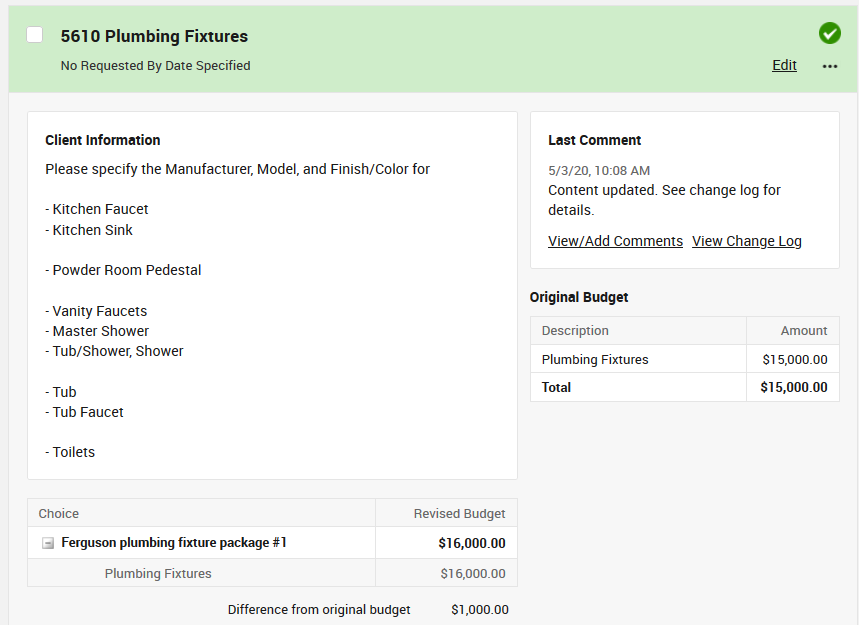

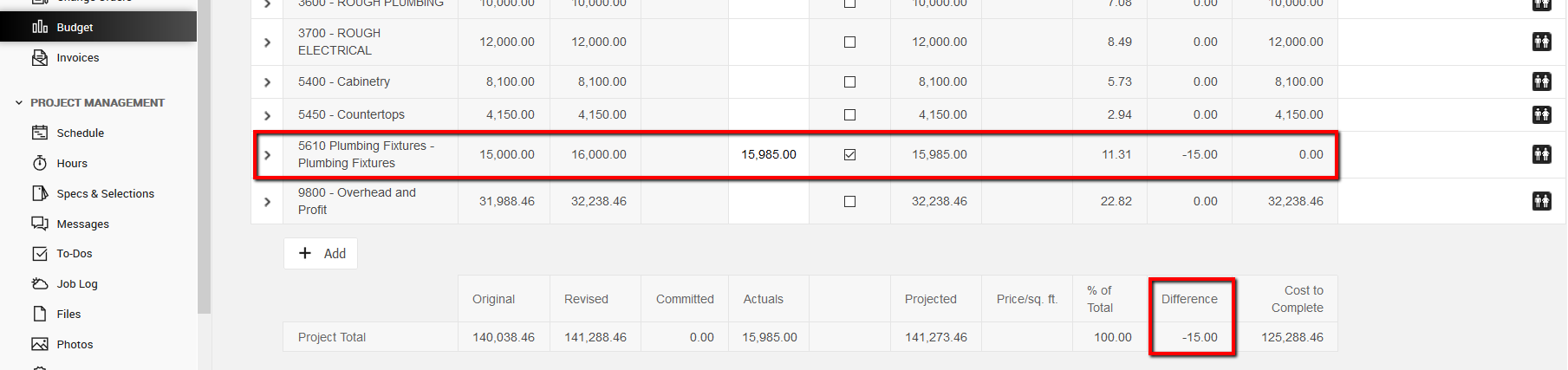

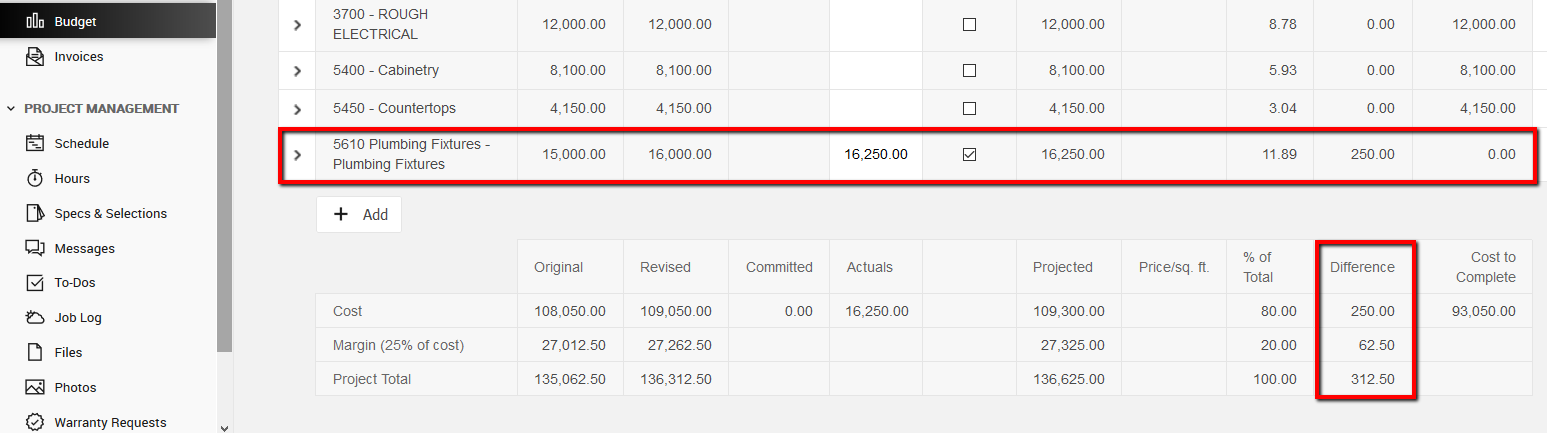

For example, if you had budgeted in your estimate $15,000 for plumbing fixtures, this number would be represented in your original budget. The client then makes their selections to a total of $16,000. When entered as a choice on the Specs & Selections page, the $16,000 total is reflected in the revised budget column of your project’s Budget.

If your final actuals for plumbing fixtures then ends up being only $15,985, the difference of $15 will be returned to your client as a credit in the budget adjustments section once that line has been marked Complete in the budget.

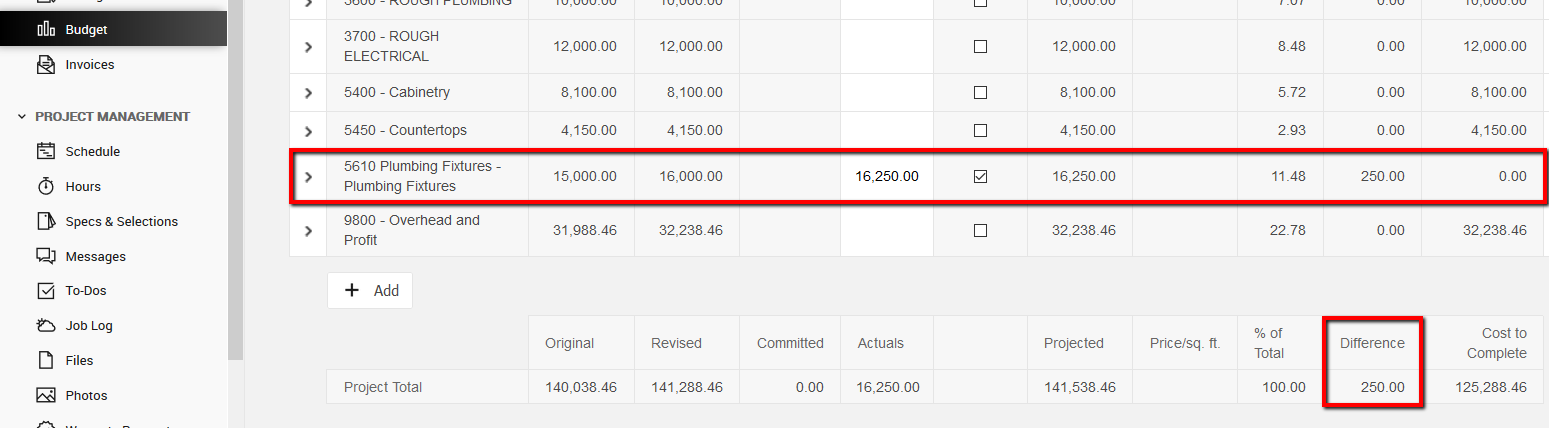

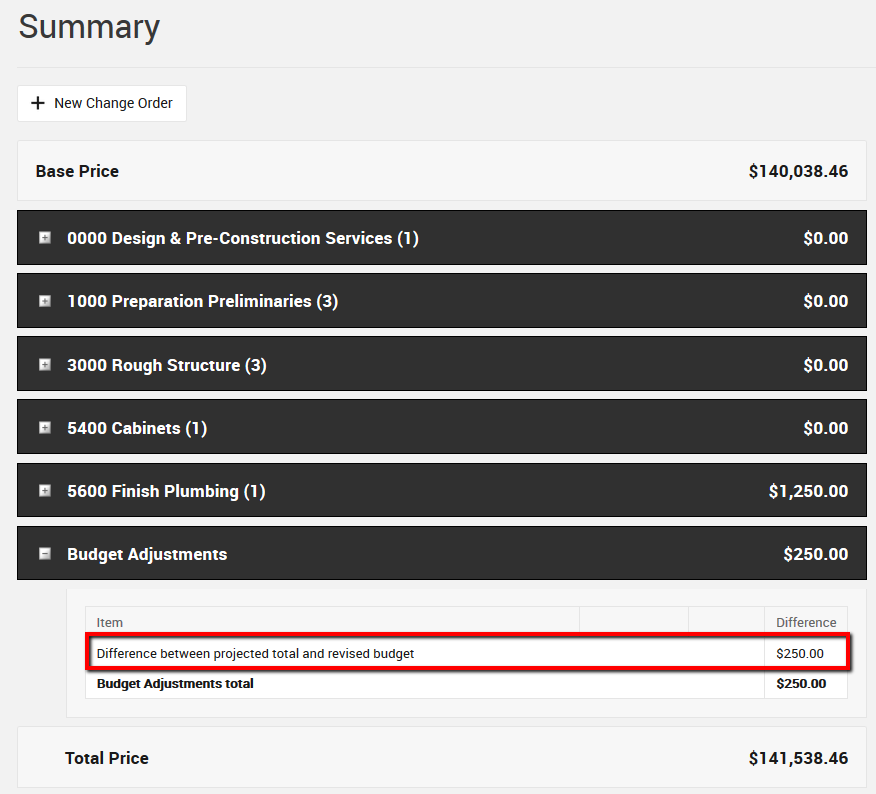

Accounting for Overages

On the other hand, if the actuals exceed the revised budget and you actually end up paying $16,250 for the plumbing fixtures, the budget adjustments will reflect an overage of $250. This overage will automatically be added to your client’s total project cost as part of their open book agreement.

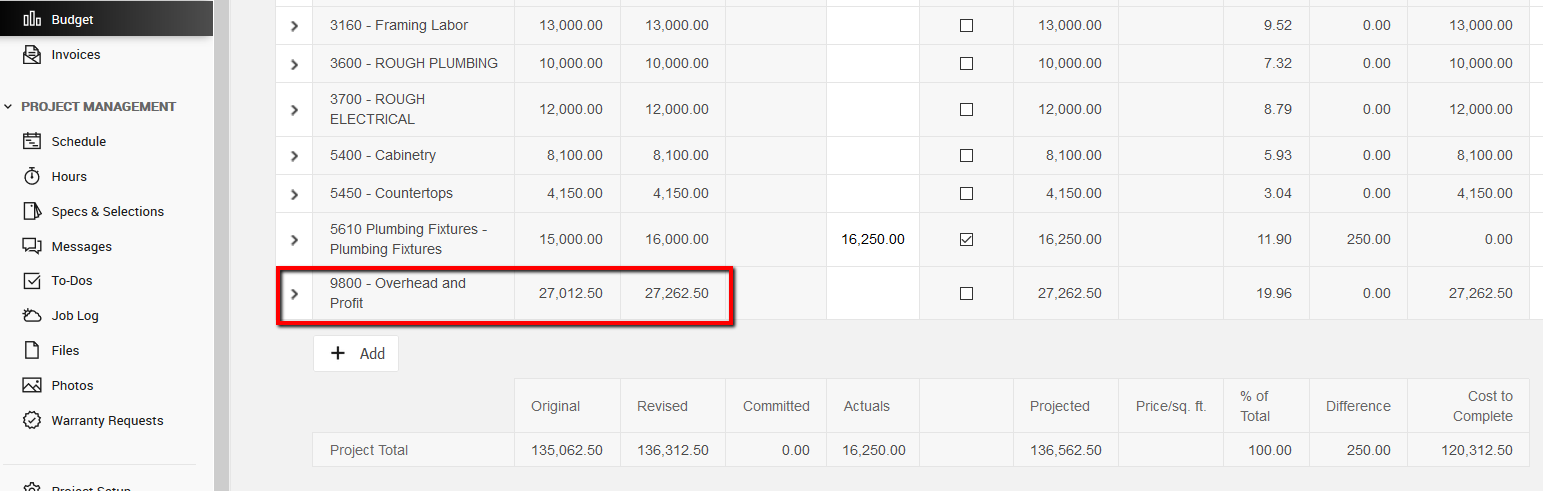

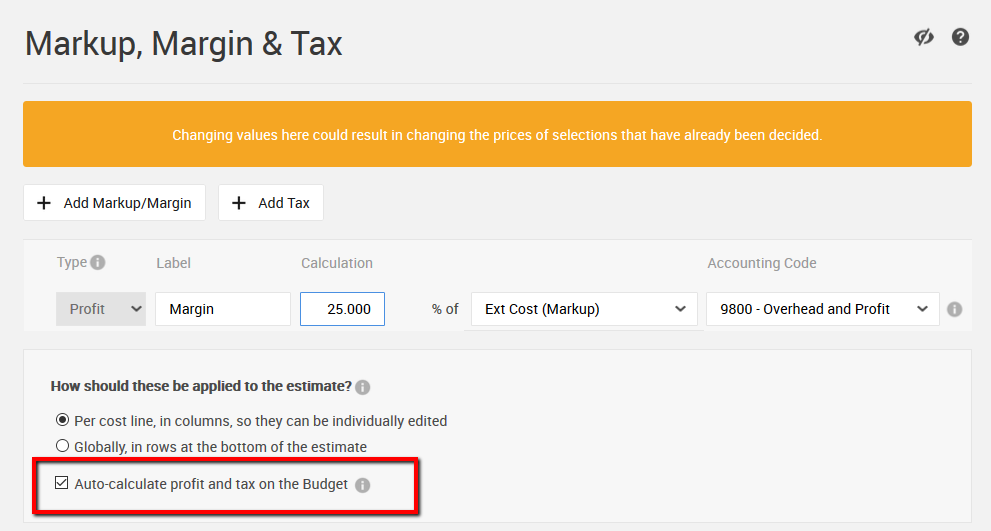

Leveraging Auto-Calculate Profit & Tax

If you're using the Auto-Calculate profit and tax on the budget page feature within the Markup, Margin & Tax configuration on the estimate. The Difference between projected total and revised budget number will also include any adjusted markups on the overage/credit from your actuals.

Taking the above example, our actual costs were $250.00 higher than our revised budget amount. The Auto-calculate feature will apply our 25% markup on that overage. In this example, an extra $62.50 in profit is applied ($250 * 25%), making the total difference $312.50.

Either way, the budget adjustments for "Difference between projected total and revised budget" should reflect the cumulative "Difference" from the bottom of your budget page.

For more details on using the auto-calculate feature, review our Help Center article here.