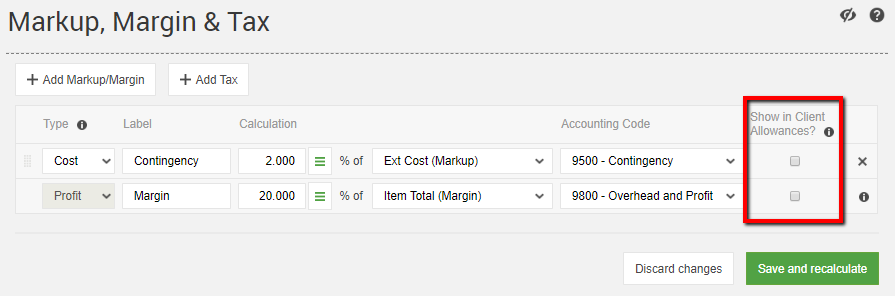

For each of the markup, margin and tax calculations on your fixed price projects, you have the flexibility to choose whether the markup should be included in the allowances that you present to your clients.

So, if you want to account for your profit margin throughout your estimate, but without marking up the allowances that you present to your clients on your fixed price jobs, you can uncheck the option to "Show in Client Allowances" on the Markup, Margin & Tax page.

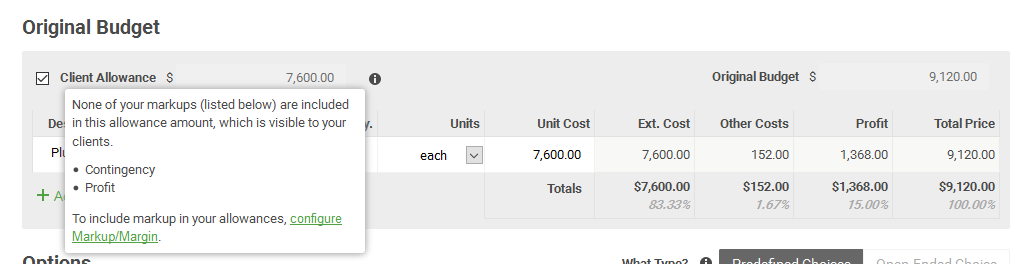

Unchecking that option will lock in the profit that you set in your original budget. You won't be able to tweak or additionally customize the markup for the choices that your clients make, since that will all be determined by your original budget.

The selection will show the client's allowance relative to your original budget, and you can click on the info icons to learn more about the markups that are included in the allowance.

If you want to mark up an overage at a higher rate, while getting that additional signoff from your client, set up a new change order and you can mark up the overage there.

Click here for more info on marking up allowance overages on a change order.

Setting defaults for whether your allowance amounts include your markup

Just like other changes you can make to the markup, margin & tax configuration, changes to the "Show in Client Allowances" setting once a project is underway can have big implications on the financials for your projects, including the allowance amounts that your clients see and the overall total for the project.

With that in mind, keep this setting in mind for future projects or projects that are still in prospect status, rather than updating projects that are currently underway.

To set the defaults for your new jobs, head to these places:

- The Settings > Estimating page for your account will set the default config for new projects

- The "Configure Markup, Margin & Tax" option for each of your selection templates will set the config associated with your various templates.

Learn more about copying markup options from a template to a project.

Markup scenarios that are not supported with this feature

If you have multiple markup calculations on your projects, you may find a combination of markup calculations and "Show in Client Allowances" checkboxes that is unsupported in CoConstruct.

This will occur when a markup that is NOT included in allowances is being used in a calculation by another markup calculation that IS included in allowances.

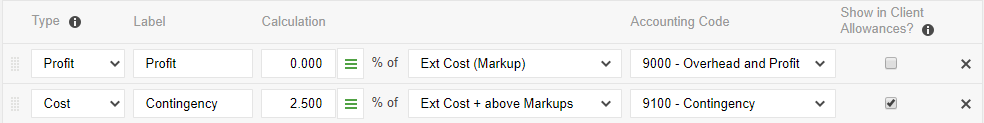

As an example, consider the following markup combination (click to view full-screen):

Profit is not shown in client allowances, but Taxes after Profit is.

In this case, Contingency is an "Ext Cost + above Markups" calculation, meaning it is applying a 2.5% contingency after already factoring in the 20% profit markup.

Profit is not shown in allowances, but contingency is, so when determining the client's allowance, the Taxes after Profit calculation will be trying to add markup on top of something that doesn't exist.

Cases like this should be few and far between, and you will only be affected if you do have some of these more advanced markup scenarios with multiple calculations.

If you do encounter this, you can still customize markup lines to remove markup from your allowance selections, and move that markup total down into the Other Line Items of your estimate.

Showing taxes in client allowances

While you may be limited in the markup/margin calculations that you want to show/not show in client allowances, tax calculations are slightly different and can always be shown or hide, regardless of whether other markups are shown or hidden.

If you are running a fixed price project with allowance items, and you are required to collect and report on sales tax (like GST) from your clients, you can check or uncheck "Show in Client Allowances" at any time for your tax.

For different scenarios where you are showing tax, but not profit, or vice versa, your allowance and client price calculations may include an adjusted tax amount to ensure that tax is included accurately throughout your estimate.